irs tax levy form

Complete Edit or Print Tax Forms Instantly. The IRS used Form 668-A c to notify you and your financial institution of a levy.

The IRS releases a levy on third parties by issuing form 668-D.

. Power of Attorney and Declaration of. Please contact Levy and Associates to schedule an appointment with an IRS specialist today. Ad Dont Face the IRS Alone.

Please see below for links to various IRS forms. Processing the IRS Notice of Levy. The Internal Revenue Code IRC authorizes levies to collect delinquent tax.

Related

It is different from a lien while a lien makes a claim to your assets as. Ad Access IRS Tax Forms. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Get A Free IRS Tax Levy Consultation. Employers Quarterly Federal Tax Return. Get Your Free Tax Review.

The IRS generally uses Form 668W ICS or 668-W CDO to levy an individuals wages salary including fees bonuses commissions and similar items or other income. Review Comes With No Obligation. The IRS Notice of Levy Form 668-AICS is submitted to OBM to place a hold on the supplier record in OAKS FIN.

Where does Internal Revenue Service IRS authority to levy originate. The Internal Revenue Service reminds taxpayers and tax professionals to use electronic options to support social distancing and speed the processing of tax returns. Get Free Competing Quotes From Tax Levy Experts.

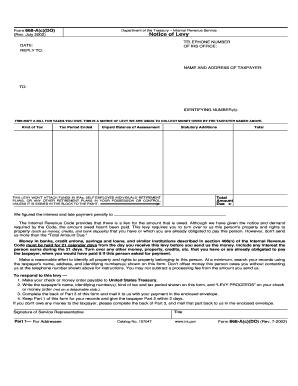

It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real. July 2002 THIS ISNT A BILL FOR TAXES YOU OWE. Review Comes With No Obligation.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. How to generate an electronic signature for signing the Irs Form 668 D Release Of Levy in Gmail irs levy releaseusinesses have already gone paperless the majority of are sent through email. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The release of levy on property seized from the taxpayer is form 668-E Form 668-D has provisions for a partial release of levy. Trusted Reliable Experts. If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing.

No Fee Unless We Can Help. The levy is not continuous and only affects the money in the account on the day the levy is acted upon. Levy Relief Form 668-A Notice of Levy bank Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of.

Ad Remove IRS State Tax Levies. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Even if you think you do not owe the tax bill you should contact the IRS.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. Contact the IRS immediately to resolve your tax liability and request a levy release. Get Your Free Tax Review.

Trusted Reliable Experts. OBM State Accounting receives the Notice. Department of the Treasury Internal Revenue Service Notice of Levy on Wages Salary and Other Income Form 668-WcDO Rev.

No Fee Unless We Can Help. Ad Remove IRS State Tax Levies. Employers who withhold income taxes social security tax or Medicare tax from employees paychecks or who must pay.

Dont Let the IRS Intimidate You. The IRS can also release a levy if it determines that the levy is causing an immediate economic. Collection Appeal Request February 2020 Department of the Treasury - Internal Revenue Service Instructions are on the reverse side of.

2003 2022 Form Irs 668 B Fill Online Printable Fillable Blank Pdffiller

Irs Notice Federal Tax Lien Colonial Tax Consultants

Form 668 D Pdf Fill Online Printable Fillable Blank Pdffiller

Form 668 W 2021 Fill Online Printable Fillable Blank Pdffiller

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Notices Form 668 Y C Understand Form 668 Y C Lien Notification

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

What Are The Series 668 Forms All About Astps

Irs Notices And Letter Form 668 A C Understanding Irs Notice 668 A C Notification Of Levy

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

Irs Tax Lien Versus Irs Tax Levy

5 19 9 Automated Levy Programs Internal Revenue Service

Irs Form 668 W C Tax Attorney Steps To Stop Wage Levy Taxhelplaw

Irs Form 668 D Fill Out And Sign Printable Pdf Template Signnow

Irs Form 8519 Understanding Form 8519

Irs Form 668 A Pdf Fill Online Printable Fillable Blank Pdffiller

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien