stanislaus county tax collector property tax

See California Public Records. 1st installment payment for 2022 property taxes due by June 30.

Stanislaus County Is Red Faced Over Message On Tax Letters Modesto Bee

Secured property tax bills will be mailed in the fall.

. Stanislaus County has one of the highest median property taxes in the United States and is ranked 525th of the 3143 counties in order of median property taxes. Get driving directions to this office. Free Stanislaus County Treasurer Tax Collector Office Property Records Search.

Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022. Senior Tax Worker Program The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. Property Taxes Search andor Pay Property Tax On-line To start a search choose the Property Tax button on the top left.

Automate state and local taxes on rental properites so you can focus on guest experience. Levy County Tax Collector 310 School Street Room 100 Bronson FL 32621 Phone. Give us your questions comments or feedback.

The median property tax on a 28520000 house is 299460 in the United States. Update Address with the Property Appraiser. Report an environmental concern.

Masks are optional for visitors of County facilities but are strongly encouraged. Please include the stubs for all the properties being paid. If you do not have the stub s list the parcel number s andor address es on a piece of paper and send it with your payment to.

Tax Certificate Tax Deed. 1010 10th Street Suite 2400. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

Find Stanislaus County Property Records. Box 770 - Modesto CA 95354. Property taxes ad valorem tax and special assessments are collected by the County but governed by California State Law.

Access Millions Of Verified Public Records. Property Taxes in Pinellas County. Ad Fast Easy Access To Millions Of Public Records.

The Tax Collectors Office is open to the public from 900 AM - 500 PM Monday through Friday. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. Official 2022 tax roll opens Nov 1.

Please mail early to avoid penalties. 209 525 6461 Phone 209 525 6586 Fax The Stanislaus County Tax Assessors Office is located in Modesto California. You can call the Stanislaus County Tax Assessors Office for assistance at 209-525-6461.

Stanislaus County Property Records are real estate documents that contain information related to real property in Stanislaus County California. About Us Who We Are. When contacting Stanislaus County about your property taxes make sure that you are contacting the correct office.

Stanislaus County collects on average 066 of a propertys assessed fair market value as property tax. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. As the elected Assessor of Stanislaus County it is my sworn responsibility to uphold the States Property Tax Laws.

Search Stanislaus County Records Online - Results In Minutes. Ad Find Stanislaus County Online Property Taxes Info From 2021. The Tax System is available for credit card and debit card payments.

Modesto California 95354. Ford Stanislaus County Tax Collector PO Box 859 Modesto CA 95353. The Treasurer-Tax Collector will send unsecured tax bills starting July 18 2022.

Going Out Of Business. The median property tax on a 28520000 house is 188232 in Stanislaus County. If you have documents to send you can fax them to.

Find Stanislaus County residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more. Reach us 24-hours a day. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Property Taxes and Assessments Division. Remember to have your propertys Tax ID Number or Parcel Number available when you call. The median property tax in Stanislaus County California is 1874 per year for a home worth the median value of 285200.

The median property tax on a 28520000 house is 211048 in California.

California Public Records Public Records California Public

Zoning Stanislaus County California Data Basin

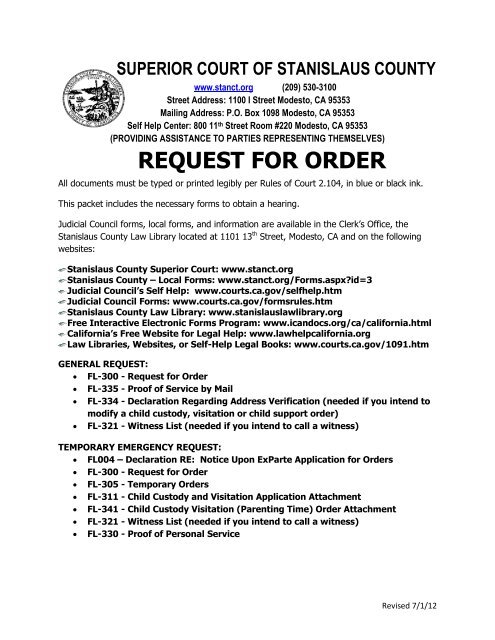

Fl 300 Request For Order Stanislaus County Superior Court

County Of Stanislaus Civicmic Data Center Outreach Engagement

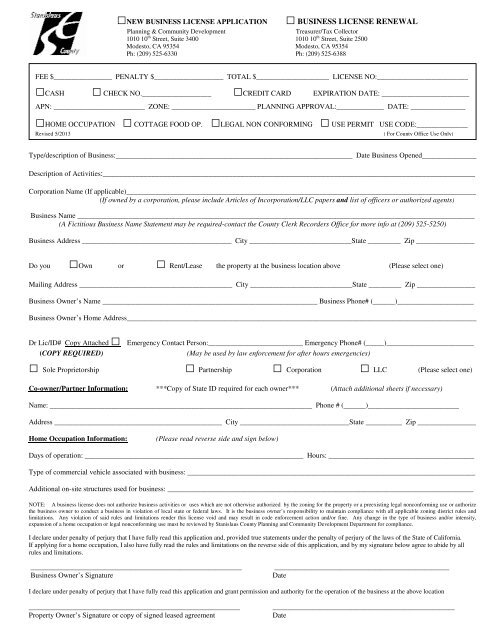

Business License Application Stanislaus County

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Contacts Treasurer Tax Collector Stanislaus County

2022 Best Places To Buy A House In Stanislaus County Ca Niche

Stanislaus County Is Red Faced Over Message On Tax Letters Modesto Bee

California Drought Why Doesn T California Build Big Dams Any More The Mercury News

Stanislaus County To Conduct First Ever Online Tax Sale On Bid4assets

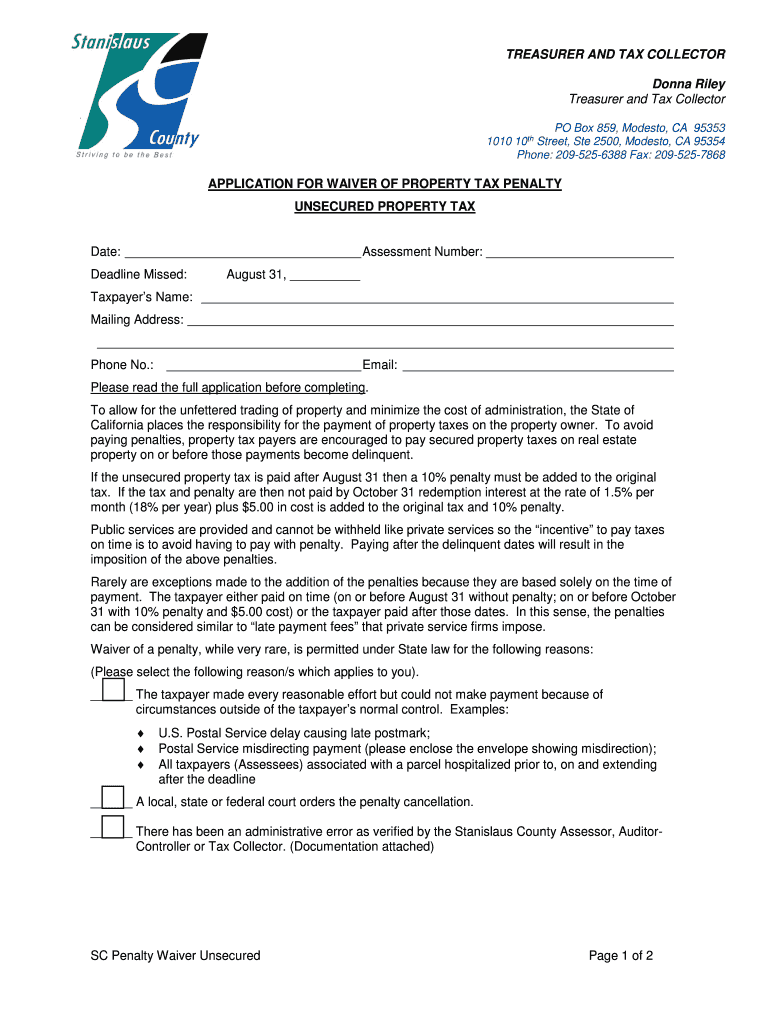

Ca Application For Waiver Of Property Tax Penalty Unsecured Property Tax Stanislaus County Fill And Sign Printable Template Online Us Legal Forms